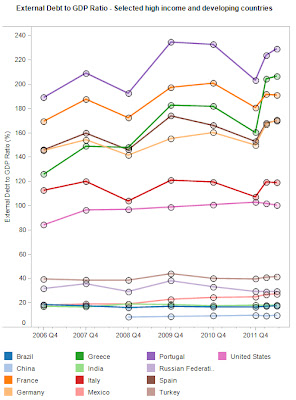

According to the World Bank, it appears that while some developing countries managed to balance their checkbooks despite the worldwide economic downturn, the struggle continues for wealthier countries to decrease their debt. In the United States, our external debt to GDP ratio has increased from 84.1% in 2006, to 100.2% in 2012. In comparison, Portugal's external debt to GDP ratio is the highest among all the countries measured. From 2006 to 2012, their debt ratio increased from 189.0% to 228.9%. Greece has the second highest ratio but endured the largest increase in the debt ratio. In 2006, the World Bank estimated that their debt ratio stood at 125.8%. By 2012, it exploded by more than 80% to 206.4%. France has the third highest debt ratio, 190.8%, followed by Germany at 170.4%, Spain at 169.7%, Italy at 118.9%, and then the United States at 100.2%.

Interestingly, despite the struggles of developed countries to stabilize their debt, developing countries continue to enjoy low levels of external debt to GDP ratios. China's ratio stood at 9.5%, followed by 17.2% for Brazil, 18% for India, 27% for Mexico, 29.3% for Russia, and 41.3% for Turkey.

Blog Archive

-

▼

2013

(4037)

-

▼

January

(103)

- A State of Trance 598

- Global DJ Broadcast

- Dabai Jeruk

- Letter RIP - Game Video

- Duck Fat Roasted Brussels Sprouts – P.H.A.T. with ...

- Lyrics: 50 Cent ft. Young Jeezy and Snoop Dogg - ...

- U.S. Immigrant Population Continues to Grow

- Fried Mushroom Dumplings (Cucur Cendawan Tiram)

- Last Call for ICPSR Research Paper Competition Ent...

- Kek Lapis Biskut Kacang Tumbuk

- Extrema 300

- Baked Crab and Artichoke Dip – A Snack So Nice, Yo...

- Lyrics: Kyau & Albert - Nightingale

- Letter RIP

- Six Ways to Build Successful Teams

- Wealthy Countries Continue to Struggle with High E...

- Lyrics: Kyau & Albert - At Any Time

- Assorted Sarawak Acar / Chutney

- Lyrics: Kyau & Albert - The One

- Liana Bergaya untuk Makcik2 Tersayang

- Lyrics: Bon Jovi - Bed of Roses

- Lyrics: BT vs. Sasha ft. Jan Johnston - Remember M...

- Chocolate Chip Fudge Cookies

- Little Progress Made in Reducing Obesity Levels

- Lyrics: Oasis - Champagne Supernova

- International Departures 165

- Lyrics: Atlantic Starr - Masterpiece

- The Curiousity Club 10

- Super Bowl Spoiler Alert: San Francisco 49ers Will...

- A State of Trance 597

- Global DJ Broadcast

- Union Membership on the Decline

- Gabal - Game Video

- Creamy Fettuccine

- I Dip, You Dip, We Dip

- 40 Years of Roe v Wade

- Lyrics: Macklemore & Ryan Lewis ft. Mary Lambert -...

- Read A Good Book Lately?

- Lyrics: Kyau & Albert with Adaja Black - Could You...

- Re-published from Oilprice.com

- Gabal

- Looking Forward In 2013

- How to Butterfly, Stuff, Roll, and Tie a Pork Roas...

- Lyrics: Mikkas & Amba Shepherd - Finally

- The use of synthetic master events for waveform cr...

- Seismicity of the North Atlantic as measured by th...

- Waveform cross correlation at the International Da...

- Lyrics: Kyau & Albert with Stoneface & Terminal - ...

- Can Obama's second term outperform his first?

- Lyrics: TOKiMonsta ft. Kool Keith - The Force

- Lyrics: Bon Jovi - Because We Can

- Go On Air 024

- Gaining Weight at the Taste Awards

- Lyrics: tyDi ft. Brianna Holan - Home

- Lyrics: Woody van Eyden & Alex M.O.R.P.H. ft. Mich...

- Lyrics: Lustral - Broken

- Efficacy of Kickstarter

- Lyrics: Goo Goo Dolls - Iris

- A State of Trance 596

- Global DJ Broadcast

- Two weeks left for submissions to ICPSR Research P...

- Professional sniper - Game Video

- Baked Eggplant Sandwiches – Get’em While They’re R...

- International Departures 164

- An Award-Winning Smoked Goose

- Lyrics: Justin Timberlake ft. Jay-Z - Suit & Tie

- Lyrics: Roxanne Emery - Tug Of War

- Beef Goulash! Thick Hungarian Soup, Thin Austrian ...

- Lyrics: Sneijder ft. Jess Morgan - Sky Is On Fire

- Lyrics: Armin van Buuren ft. Fiora - Waiting For T...

- Leadership and the Art of Plate Spinning

- Professional sniper

- Soup For You!

- Lyrics: Kyau and Albert - All Your Colours

- Banana Fritters (Goreng Pisang Tepung Celup Hana)

- Lyrics: Roy Malakian ft. Chris Jones - Vital Signs

- Fedde le Grand - Dark Light Sessions 023

- Layered Cake & Caramel Pudding (Kek Puding Karamel)

- Lyrics: Roxette - Listen To Your Heart

- Lyrics: Leama & Moor - Distance Between Us

- Lyrics: Creed - My Sacrifice

- Garlic Parm Hot Wings – Video Recipe 800! 800? Rea...

- Moor Music 89

- Vicky Wood - Dark Energy 007

- Lyrics: Eminem - Lose Yourself

- Sniper Duty - Game Video

- The Tuna Melt – Open Face, Insert Hypocrisy

- Business Subsidies throughout the US

- Next Up: Tuna Melt

- Lagos to Overtake Cairo as Largest African City

- Nasi Bukhari II & Ayam Goreng Bukhari

- Sausage Ribs – Deliver A Bone-Jarring Hit to Your ...

- Brilliant Business Quotes

- BlackPepper Chicken & Mushroom

- Sniper Duty

- Brigham City in a Winter Inversion

- Next Up: Sausage Ribs

- Dischi Volanti in Fresh Mushroom Sauce

- Fried Pressed Rice (Nasi Himpit Goreng)

- Mushroom Ricotta Bruschetta – This Was Anything Bu...

-

▼

January

(103)

0 komentar:

Post a Comment